Snapshot Birmingham: A key location for real estate investment in the UK

Birmingham, the United Kingdom’s second largest city, is a promising location for real estate investment. The ever-evolving city is a hotspot for creativity, culture, and innovative infrastructure. As the city continues to grow and flourish, consider looking here for a solid UK investment outside of London.

A glimpse into Birmingham’s vibrant city center

Located in the region of West Midlands, Birmingham is a booming and bustling city. Since the 18th century, Birmingham has been a hub for the manufacturing industry. And, as we move through the 21st century, the city continues to be a key locale for modernity and economic growth.

As per JLL, the average rent in Birmingham has increased by 16.7% in the past year. This is the highest increase of the ‘big six’ (Birmingham, Bristol, Edinburgh, Glasgow, Leeds, and Manchester) cities in the UK. Along with this, the average rental growth has increased by 18%.

This blog post will take a closer look at Birmingham and its property market, assessing the prominent trends and influences to breakdown the benefits of investing in real estate in this vibrant city.

The real estate market in Birmingham is offering a huge variety of investment opportunities from apartments to detached houses.

Property Market Overview

According to JLL’s “Big Six Residential Report”, Birmingham has shown consistent growth in housing costs from 2017 till now. Furthermore, since 2020 real estate values have increased by 10.5%. JLL’s data indicates that newly built one bedroom apartments averaged 253,544 USD, two bedroom apartments averaged 354,961 USD, and three bedroom apartments averaged 456,370 USD. These trends indicate that despite the limitations and setbacks experienced following the global pandemic in 2020, Birmingham is remains a strong and ever-growing place for real estate investment.

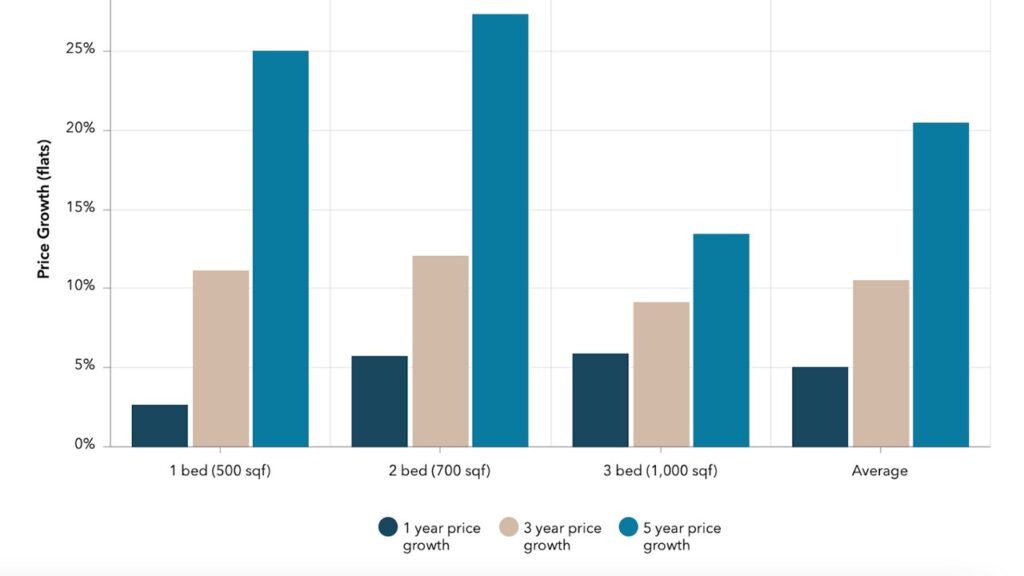

Chart: Birmingham House Price Growth H2 2022

Source: JLL’s Big Six Residential Report

The average price for buying property, when considering all housing types, was valued at 344,584 USD. Breaking this down into specific housing types:

Detached properties: 664,258 USD

Semi-detached properties: 351,125 USD

Terraced properties: 272,534 USD

Apartments and flats: 197,745 USD

Property Market Projections

According to the data, Birmingham is projected to experience increased and sustained growth between now and 2028. These positive signals are due to a variety of factors.

Increase in foreign investment: according to Prosperity Wealth, Birmingham is a hub for foreign investment and has generated over 12,000 jobs over the last ten years. Birmingham has several strong sectors, such as engineering and automotive manufacturing, making it an attractive location for foreign investment.

Demand for real estate outside of the capital: trends have indicated an increasing demand for property in UK cities outside of London. Due to Birmingham’s infrastructure, amenities, and favorable location, it has emerged as a key locale for real estate.

As seen in the table below, both sales price growth and rental growth are projected to increase in the next five years, providing a positive signal for interested investors.

Table: UK city centre house price forecasts

Source: JLL’s Big Six Residential Report

Why Invest in Birmingham?

Favorable housing prices: Compared to London, Birmingham currently has cheaper housing costs. Specifically, a property in downtown London is on average 918 USD per square foot, in Birmingham it is 358 USD. Given the projected increase in Birmingham’s housing prices, this presents a wonderful opportunity for would-be investors looking for strong returns on their investments.

Demographic: due to a large number of working professionals and university students residing in Birmingham is an excellent place for investors seeking high rental yields. The large student population, and increased number of people coming to work in the city, provides a continuous flow of new renters.

Good lifestyle options: Birmingham is an attractive place for people of all ages to live and work. Among the previously mentioned student areas, Birmingham is a thriving city that blends technology with an abundance of parks and green spaces. Making it an ideal location for property. With a steady population of ca. 1.15 million people, Birmingham is notable for its modern amenities and convenient location to other key cities in the UK. The driving distance between London and Birmingham is approximately 118 miles (or about 191 kilometers).

Birmingham has changed over the past few years from an industrial city to a modern metropolis

Key Investment Locations

There are several key locations to consider when looking at investment properties in Birmingham. Popular student areas include Selly Oak, Bournbrook, and Edgbaston. These locations provide a steady flow of people looking to rent in Birmingham’s urban center.

Looking at working professional areas in the city, consider Holloway Head, Digbeth, Erdington, and Harborne. Given the city’s demographics, these locations are essential locations for high returns on investments. These areas present a steady demand for secure and stable housing.

Conclusion

Birmingham, with its unending charm and unique history, is a hotspot for renters, buyers, and investors. Birmingham’s resilience and projected positive growth in the real estate sector make it a promising place for potential investors. If you are looking to invest in the UK property market, consider Birmingham.

Remember to keep yourself informed and receive advice from real estate professionals when looking to invest in property. Our expert advisors at Society International Real Estate are here to help.