Snapshot Manchester: A thriving real estate market

Manchester, a vibrant city in the United Kingdom, has experienced remarkable growth in its real estate sector over the past five years. As a cultural, educational, and business hub, it presents compelling reasons for investors to explore residential properties.

One standout factor is Manchester’s burgeoning population. The city center alone is projected to accommodate over 100,000 residents by the end of 2026 – a staggering 40% increase since the start of the decade. That translates to nearly 7,000 new residents annually from 2020 onward.

Looking ahead to 2028, the forecast predicts that more than 630,000 people will call Manchester home. This surge in demand has a direct impact on property values and rental rates, making it an enticing proposition for both homebuyers and investors.

In this blog post, we’ll delve into key trends, influential factors, and exciting opportunities that position Manchester as an attractive choice for real estate investment.

Impressions of Salford Quays

Market Overview

In order to properly evaluate Manchester’s housing market, we should look at various factors ranging from the demand for real estate to the employment situation all the way to market trends. According to the Manchester Property Market Report for March 2024, the local property market has been robust. Let’s compare data from the first nine weeks of 2023 to the same period in 2024:

In 2023, there were 375 sales agreed (sold subject to contract, SSTC) in the Manchester area.

In 2024, during the same period, there were 458 sales agreed – a 22.1% increase in Manchester home sales year-to-date.

In Q1 2024, the average house price for an apartment in Manchester was 307,582 USD, which represents a 3.8% increase from the average of 296,283 USD in Q2 2023. This growth outpaced the rise in the Northwest region during the same period.

Additionally, let’s break down the average prices for different property types in Manchester as of February 2024:

Detached properties: 543,605 USD

Semi-detached properties: 379,142 USD

Terraced properties: 286,240 USD

Flats and apartments: 307,582 USD

Property Market Outlook

The property market in Manchester is poised for rapid growth over the next five years. The key factors driving this include:

Shortage of Available Properties: The construction pipeline falls short of meeting the demand. For instance, the latest Deloitte Crane Survey reveals that only 11,759 new homes are in the pipeline for the city center over the next three years.

Price Predictions: JLL (Jones Lang LaSalle) predicts that house prices in Manchester will rise by ca. 17% by the end of 2028, following 4.9% growth in 2022.

Rental Growth: Rental projections are equally positive. After a 19.6% growth in 2022, the latest JLL Big Six annual report suggests a further 25.8% rental growth may be in the pipeline by the end of 2028.

UK city centre house price forecasts – Source: JLL

Employment Opportunities

The city’s appeal extends beyond its population growth. Manchester consistently offers quality and quantity of jobs, making it an extremely desirable place to live.

According to City Council figures, Manchester’s employment growth rate is approximately 2.5 times higher than the national average. It outperforms every other city in the UK, including London.

By 2040, it’s anticipated that over 315,000 jobs will be based in the city center alone. Employment hubs like MediaCityUK, home to the BBC, also contribute significantly to Manchester’s growth.

Manchester – a city between the past and the future

Other Influences

Demographic shifts, changes in housing preferences following the pandemic, and government policies have also contributed to the surge in property sales.

Regeneration Projects

Manchester stands out due to its substantial investment in ambitious regeneration projects. Mayfield and MediaCity UK are just two of the many projects, find a short brief about these regeneration projects following:

Mayfield

Mayfield is a 24-acre brownfield site undergoing a transformative mixed-use regeneration project. The site is rich in heritage, with the River Medlock flowing through its core. Once an industrial heartland, Mayfield is now being revitalized into a vibrant urban space. The development includes:

1,500 new homes

1.7 million sq ft of office space

Shops

A 650-bed hotel

Mayfield’s strategic location near Manchester Piccadilly Station and its blend of heritage and modernity make it a compelling investment opportunity.

MediaCityUK

MediaCityUK, situated on the banks of the historic Manchester Ship Canal in Salford, Greater Manchester, is a 200-acre mixed-use property development. Developed by Peel Media, it hosts media organizations and the Quayside MediaCityUK shopping center. The site was once part of the Port of Manchester and Manchester docks. Key features include:

BBC and ITV as principal tenants.

1,500 new homes.

1.7 million sq ft of office space.

Europe’s largest HD studio development.

MediaCityUK’s blend of technology, innovation, and creativity makes it a compelling hub for media and business.

Even the cancellation of HS2 (High-Speed Rail 2) won’t significantly impact Manchester’s future prospects. The city constantly evolves, offering exciting opportunities for people worldwide.

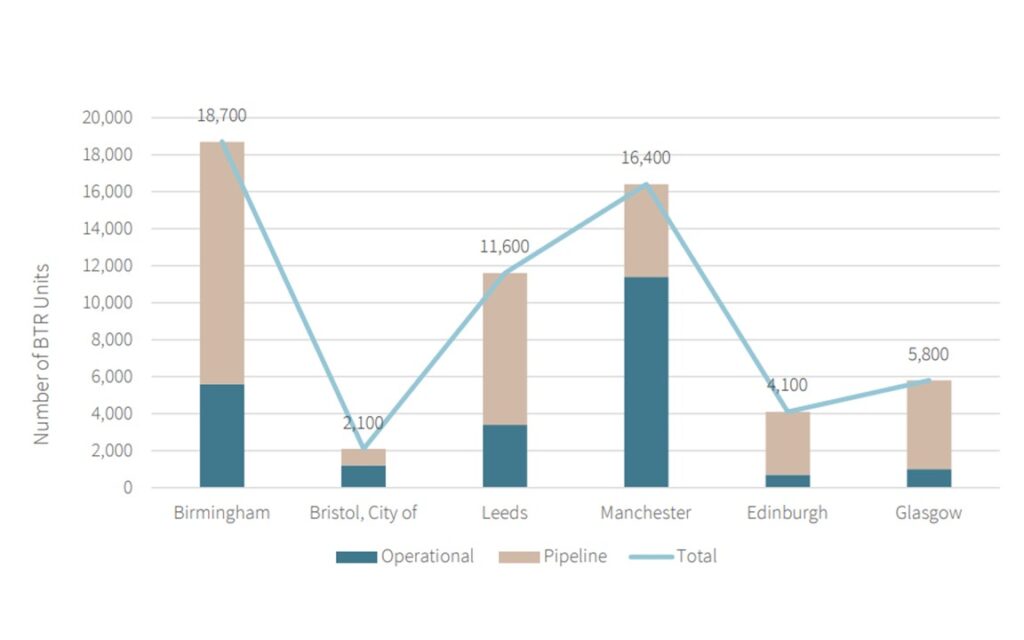

Size of the BTR market in the Big Six cities – Source: JLL Research

Manchester’s unique appeal

Education and Research Institutions Manchester is home to prestigious universities and cutting-edge research centers. These institutions attract students, academics, and professionals from around the world. As a result, there’s a high demand for quality housing to accommodate this diverse population.

St Michael’s Building, a mix-use complex that consists of a W hotel and residences with an adjacent office complex

Business and Employment Opportunities

As a thriving business hub, Manchester offers abundant job opportunities across various sectors. Professionals seeking career growth find the city an attractive destination. The availability of convenient and comfortable living spaces further enhances its appeal.

Cultural Scene and Lifestyle

Manchester’s rich cultural heritage, vibrant music scene, and dynamic lifestyle create an exciting environment for residents. The blend of historic charm and modern amenities makes it an appealing place to call home.

Infrastructure Development

Ongoing infrastructure projects, including improved transport links and urban regeneration schemes, contribute to Manchester’s overall appeal. These developments benefit both residents and investors, ensuring the city remains a desirable choice for living and investment.

Case Studies

Let’s explore some case studies and success stories related to residential real estate investment in Manchester. These examples highlight the achievements of both developers and investors in this dynamic market.

Urban Splash: Co-founded in 1993 by MBEs Tom Bloxham and Jonathan Falkingham, Urban Splash is a trailblazing property business. Their mission was to breathe new life into disused and dilapidated buildings. Over the past 28 years, Urban Splash has built more than 5,000 homes. Their innovative approach to development has transformed the industry, positioning them as one of the most exciting players. With offices across the UK, including Manchester, Sheffield, and Bristol, Urban Splash continues to build the future1.

Renaker: Renaker, a residential tower specialist, is behind Manchester’s groundbreaking Great Jackson Street masterplan. In 2021, they completed the four-tower, 1,500-home Deansgate Square. Recently, they proposed two 51-story towers that would provide nearly 1,000 new homes in the area. The wider masterplan aims to create a whole new residential district in the Deansgate area, comprising over 25 towers and 6,000 apartments. Renaker’s commitment to transformative projects has solidified their position as a leading property developer in Manchester1.

Investment Success: IP Global, a trusted partner for investors, has cumulatively invested over USD 300 million in Manchester’s real estate market. Their buy-to-let properties have thrived, capitalizing on the city’s economic initiatives and job creation. As Manchester’s population grows and demand for housing outstrips supply, investors have found lucrative opportunities in this vibrant market.

These success stories demonstrate the resilience and potential of Manchester’s real estate sector. Whether through innovative development or strategic investment, the city continues to attract attention from buyers and investors alike.

Conclusion

Manchester’s real estate market has demonstrated resilience and growth over the past five years. Whether you’re a first-time investor or expanding your portfolio, consider Manchester as a promising destination for residential property investment. Stay up-to-date with the latest news about the real estate market, explore local opportunities, and make informed decisions to capitalize on your investment.

Remember, real estate investment involves risks, so seek the advice from our professional advisors and conduct thorough research before making any decisions.