Thailand: Smart Investment Destination

When you think of Thailand, what comes to mind first? Probably endless white-sand beaches, colorful long-tail boats, and irresistible spicy street food. But if you look beyond the postcard-perfect scenes, you’ll discover a country that’s quietly transforming into one of Asia’s most appealing destinations – not just for vacations but for long-term living and smart investments.

A strong and stable economic foundation

While global markets swing wildly, Thailand’s economy shows exceptional stability. With consistent GDP growth around 3% annually and low inflation rates (hovering between 1% and 2%), the country has created a solid economic foundation that feels reassuring, especially for an emerging market.

Even more encouraging for international investors is the Thai Baht’s stability. From 2022 to 2024, the Baht fluctuated by less than 3% against the US dollar – an impressive achievement in a world where volatile currencies often erode investment returns.

A big part of this stability comes from forward-thinking infrastructure investments. The expansion of high-speed rail lines and airport projects (like Phuket’s planned second airport by 2031) prove that Thailand is planning for a sustainable future well beyond tourism.

Thailand tourism

Tourism is still the heartbeat of Thailand’s economy. In 2024, the country welcomed over 36 million visitors, surpassing pre-pandemic records. But Thailand isn’t just a revolving door for tourists, many people decide to stay for good.

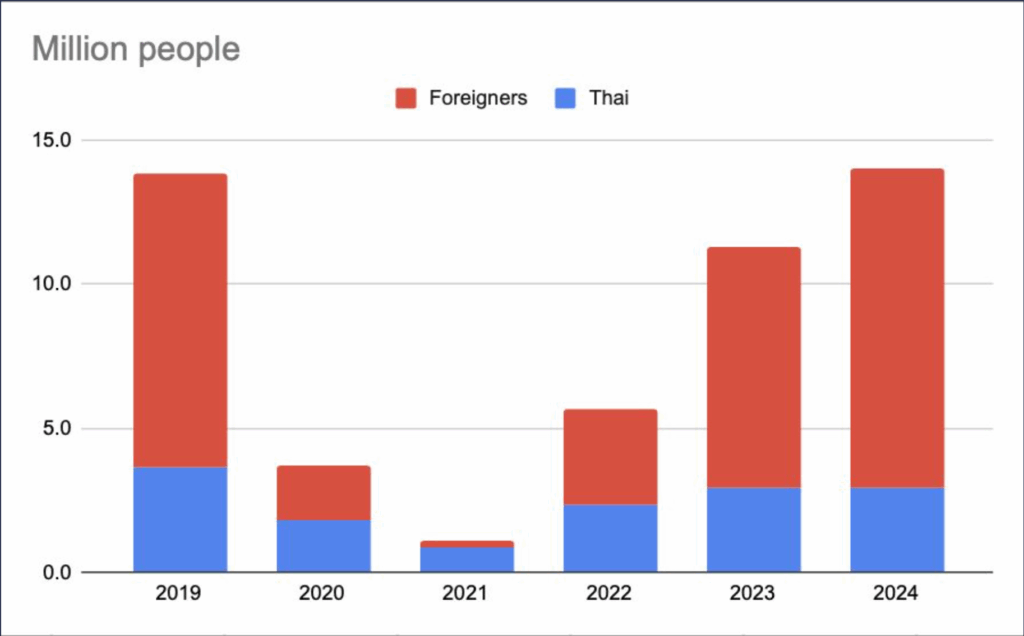

Tourist visits to Phuket in 2024 exceeds constantly growing demand for pre-COVID levels

Source: Ministry of Tourism and Sports, Thailand

Phuket, for example, has transformed from a simple backpacker haven into a vibrant hub for digital nomads, retirees, and international families. The island’s year-round appeal also ensures steady rental demand, which is vital if you’re looking for consistent income.

Supporting this lifestyle shift are Thailand’s attractive long-term visa options:

- The Thai Elite Visa (valid for up to 20 years)

- The 10-year Long-Term Resident Visa

- Retirement visas for those over 50

- A digital nomad visa tailored for the new remote workforce

Quality of life

It’s no mystery why so many visitors decide to turn their short stays into permanent homes. Thailand offers a rare combination of modern comfort and deep-rooted tradition. The country’s healthcare system is among the best globally, and Phuket alone has 15 international schools, making it a top choice for families.

Coastal areas, including Phuket, boast cleaner air and abundant green zones, creating a healthier environment than many Asian megacities. While the local culture is famously laid-back and friendly, Thailand also scores high on practical essentials: high-speed internet, modern hospitals, and a lively culinary scene that rivals anywhere in the world.

Real estate market: opportunities for every investor

Foreigners can legally own:

- Freehold condominiums (up to 49% of a building’s area).

- Villas on long-term leasehold agreements (up to 90 years, typically structured as 30+30+30).

Strict zoning laws in Phuket mean that only around 20% of the land is available for residential development. Height and density restrictions ensure that the island doesn’t become overcrowded, supporting property value stability.

Attractive prices

Thailand’s property market, especially in Phuket, stands out not only because of its affordable entry prices but also thanks to its exceptionally strong rental yields and long-term capital appreciation.

Competitive Entry Prices

- Villas in Phuket start at approximately $300 000, often including private pools, sea views, and high-end finishing.

- Condos typically start from $80 000 depending on location and amenities. Projects near popular beaches or close to international schools often fetch higher prices.

Despite rising global property prices, Phuket remains significantly more affordable than comparable markets like Bali or Dubai. For example, a beachfront villa in Bali may start at $500 000-$700 000, while in Dubai, prices can exceed $1M for a similar level of luxury.

High rental yields

One of the most compelling reasons to invest in Phuket is its strong rental yield, often ranging between 6% and 8% annually. In certain high-demand projects and prime beachfront locations, yields can even reach 9-10%.

Phuket’s tourism-driven market offers strong potential for short-term (daily/weekly) rentals, which typically generate 20–30% higher income compared to long-term leases. Many investors successfully use platforms like Airbnb or work with local property management companies to achieve higher occupancy and maximize cash flow.

Thailand’s real estate market is becoming more liquid, especially in Phuket. The combination of international demand and strict zoning (limiting oversupply) allows for easier resale, often at a profit.

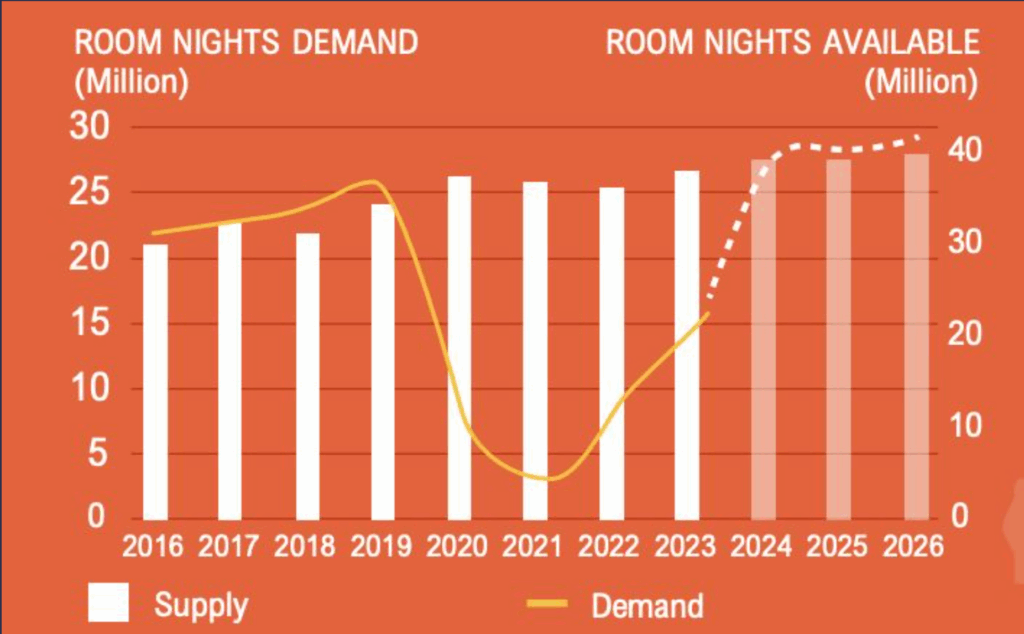

Constantly growing demand for pre-COVID levels hotel rooms in Phuket

Source: С9 Hotelworks

How to Maximize Returns?

- Invest in under-construction projects: Early-bird pricing can be up to 20–30% lower, allowing immediate value growth upon completion.

- Focus on prime locations: Beachfront areas or properties near popular hubs (e.g., Laguna Phuket, Bang Tao) tend to outperform in both rental yield and appreciation.

- Use professional rental management: Local operators handle bookings, maintenance, and marketing, optimizing occupancy and nightly rates.

Why Thailand?

Thailand isn’t just a holiday destination; it’s a lifestyle and an investment strategy rolled into one. With its perfect blend of stable economy, welcoming policies, excellent infrastructure, and luxurious yet affordable living, Thailand stands out as one of the most attractive options for global investors today.

Phuket, in particular, offers the best of all worlds tropical beauty, modern amenities, solid returns, and an international community that feels like home.

At Insight Estate, we help clients worldwide navigate the Thai real estate market with confidence. From investment strategy and property selection to legal support and full management, we handle everything, so you can focus on living your best life in Thailand.

FAQ

1. Can foreigners own land in Thailand?

No, foreigners cannot directly own land. However, they can own condominiums freehold and lease land on long-term contracts.

2. Is property in Phuket a good investment?

Yes! Thanks to strict zoning, strong demand, and year-round tourism, Phuket properties often see excellent capital growth and solid rental yields.

3. How safe is it to invest in Thailand?

Very safe, if you work with licensed professionals and conduct proper due diligence.

4. What are the taxes involved in buying property?

Taxes include a transfer fee (~2%), specific business tax (~3.3% if sold within five years), and stamp duty (~0.5%). Maintenance fees vary by project.

5. Can I manage my property remotely?

Yes! Many developers offer full turnkey services, including rental management, maintenance, and even furnishing.

6. How can I finance a property purchase?

Foreigners typically buy in cash, but some local banks do offer loans with higher requirements. Many developers also provide installment payment plans.

If you’re considering a real estate purchase in Thailand, rest assured — our local partner is exceptionally well-positioned to guide you through every step of the buying process. Explore a selection of their prestigious listings on our website, or feel free to contact us directly with any inquiries.